Retiring at Age 65

Financial Advise on how to save enough to retire at 65

Retiring can be a tricky question. It is very difficult to decide what age to retire and financial and personal circumstances the retirement will be. It cannot even be planned as you do not know how long your retirement life will be.

This particular page will give you information regarding funding for your requirement. This is factual in nature supported by research papers.This means it does not consider your personal circumstances at that particular point of time. The retirement age, income amount required to reach your goals varies from person to person.

If you need any advice regarding this it is advisable to speak to a qualified professional financial adviser and do not rely on this page to make a serious retirement decision. This is just a base which will give you an idea on how retirement funds take place.

INCOME

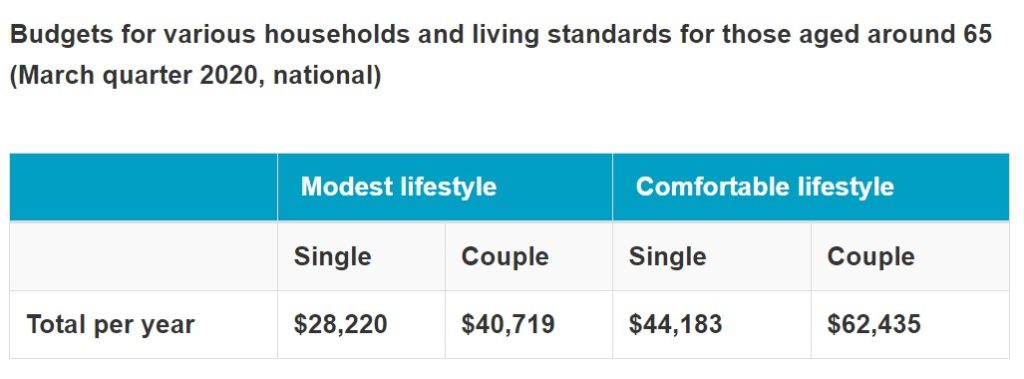

Every year the AFSA – The association of superannuation funds of Australia, Publishes the standards which aids in calculating what is considered a comfortable and modest Lifestyle income in retirement life.

Both these budgets have another option that the retirees have their own houses and are relatively healthy. There are different calculations for both single and couple Lifestyles.

Source:https://www.superannuation.asn.au/resources/retirement-standard

The figures make an assumption that retirees own their own houses and they relate to the expenses of the household. These expenses can be greater than the income after the income tax is deducted where there will be a drop down on the capital throughout the period of retirement.

Source: https://www.superguru.com.au/retiring/how-much-super-will-i-need

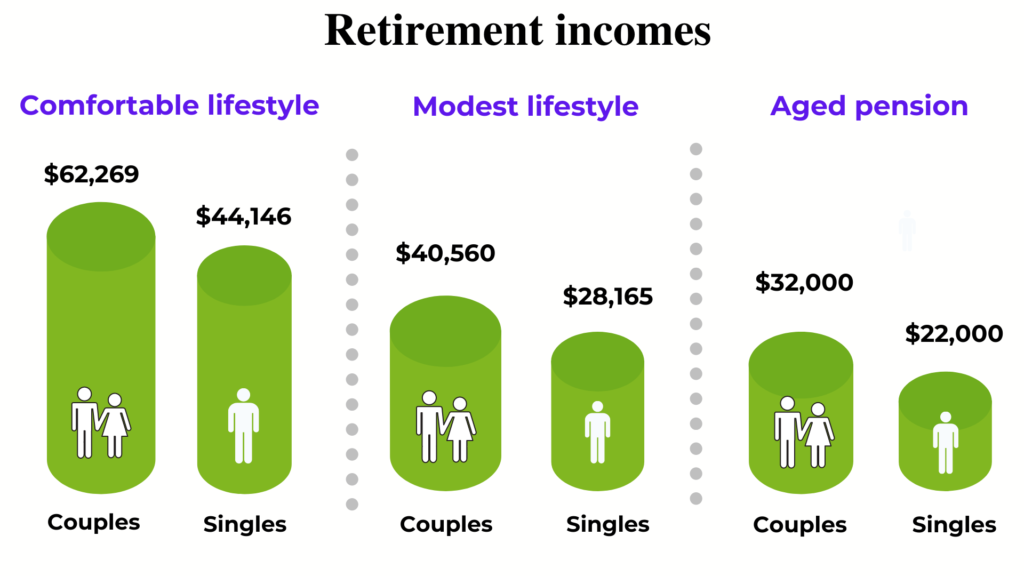

The above chart breaks this down into the literal day-to-day impacts of the income level and the lifestyle in retirement life.

As it can be clearly seen, there are huge impacts based on lifestyle as comfortable, modest or only the pension on retirement.

ASSETS

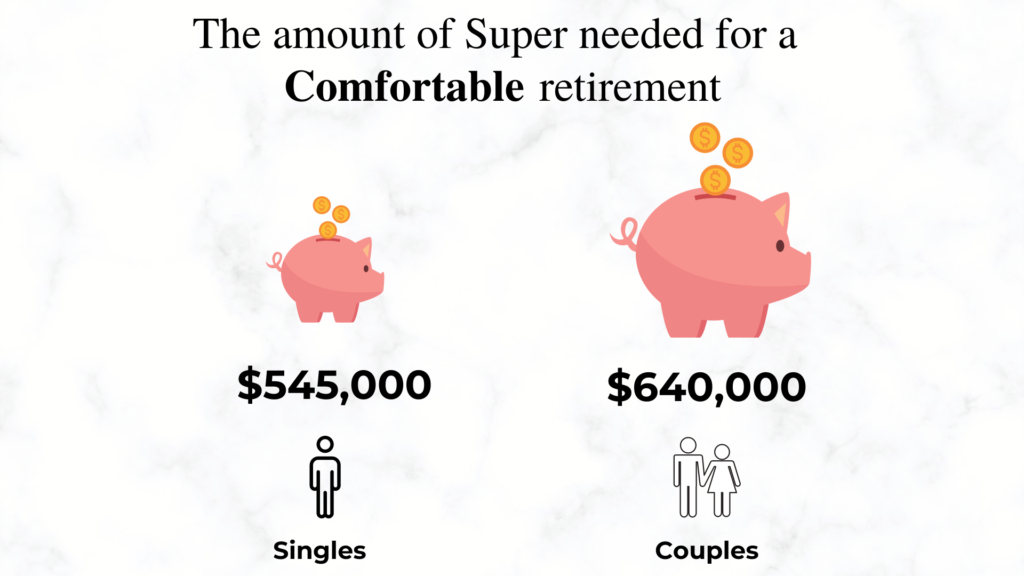

If you want to achieve the incomes above, The Association of Superannuation Funds of Australia has calculated the superannuation balance that is required for those who are very tired around the age of 65 years.

This also assumes all the capital except for the family house and the personal assets is drawn down by the end of the retirement or the life expectancy that means not much superannuation is left for the kids.

As shown above, a couple targeting a comfortable income in the retirement life would require a superannuation of at least $6,40,000 or $5,45,000 per person.

All the information stated above is just a guide as it does not consider personal circumstances. If you do not know your retirement plan, it is crucial that you speak to a qualified professional financial adviser who will consider your personal circumstances and give you an apt solution.